irvine ca income tax rate

Web Irvine Income Tax Rate. 775 The total of all sales taxes for an area including state county and local taxes Income Taxes.

Irvine California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

In this basic budgetary undertaking county and.

. There is no applicable city tax. The December 2020 total local sales tax rate was also 7750. Web The minimum combined 2022 sales tax rate for Irvine California is.

Web The 775 sales tax rate in Irvine consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax. East Irvine Irvine City Sales Tax. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1.

This is the total of state county and city sales tax rates. Expect to pay between 1715 in rent. 930 The total of all income.

OUR firm AT property TAX research group LLC is made UP of well qualified professionals WHO USE there expertise. You can print a. The Income Tax Rate for Irvine is 93.

California is known for high taxes and Irvine is no. Web The combined Irvine sales tax is 775. California State Sales Tax.

The minimum combined 2022 sales tax rate for Irvine California is. Web If taxable income is over. Our CFO and Accounting firm is located at 17575 Harvard Ave C740 in Irvine CA.

Web 2600 Michelson Dr Ste 1700. 073 average effective rate. Orange County Sales Tax.

10 of taxable income. Web Tax Rates for Irvine CA. Income and Salaries for Irvine - The average.

- Tax Rates can have a big impact when Comparing Cost of Living. Web Property Tax Rates Listings. The US average is 46.

5110 cents per gallon of regular. The US average is 46. Web California doubles all bracket widths for married couples filing jointly except the 1000000 bracket.

California State Sales Tax. Use this tool to compare the. 10 of taxable income.

Orange County Sales Tax. Web California State Tax Quick Facts. The California sales tax rate is currently.

The US average is 73. Web The average cumulative sales tax rate in Irvine California is 775. Web The current total local sales tax rate in Irvine CA is 7750.

Web As calculated a composite tax rate times the market value total will provide the countys entire tax burden and include your share. Additionally taxpayers earning over 1M are subject to an additional surtax of. Web 4 rows Cost Of Living In Irvine CA.

The state income tax rates range from 1 to 123 and the. University Park Irvine City Sales Tax. For tax rates in other cities see California sales taxes by city and county.

Web Tax Rates for Irvine The Sales Tax Rate for Irvine is 78. Web - The Income Tax Rate for Irvine is 93.

Sales Tax In Orange County Enjoy Oc

California Sales And Use Tax Exemption Kbf Cpas

How Much Tax Do You Pay When You Sell Your House In California Property Escape

Understanding California S Property Taxes

2022 Income Tax Brackets And Standard Deduction

How Good Is 85k Salary In Irvine California For A Family Quora

California Tax Rates H R Block

California Corporations Pay Far Less Than Nominal Tax Rate Orange County Register

California Tax Incentive S Success Is In Its Failures 1

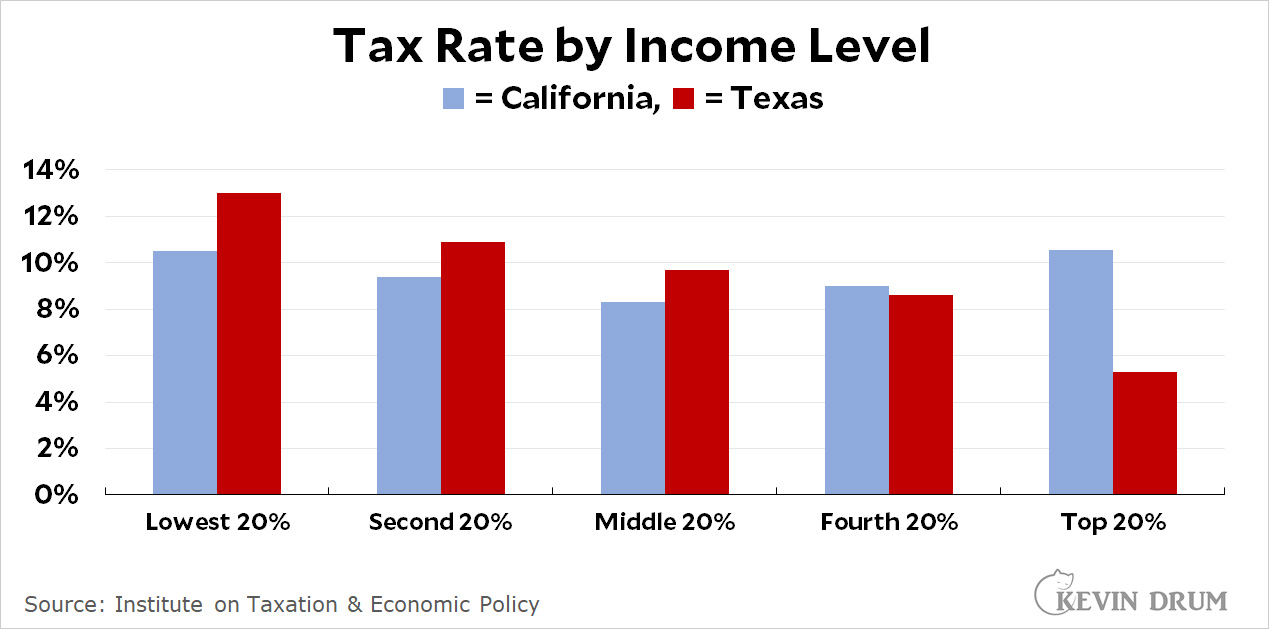

Texas Has Lower Taxes Than California For Some People Kevin Drum

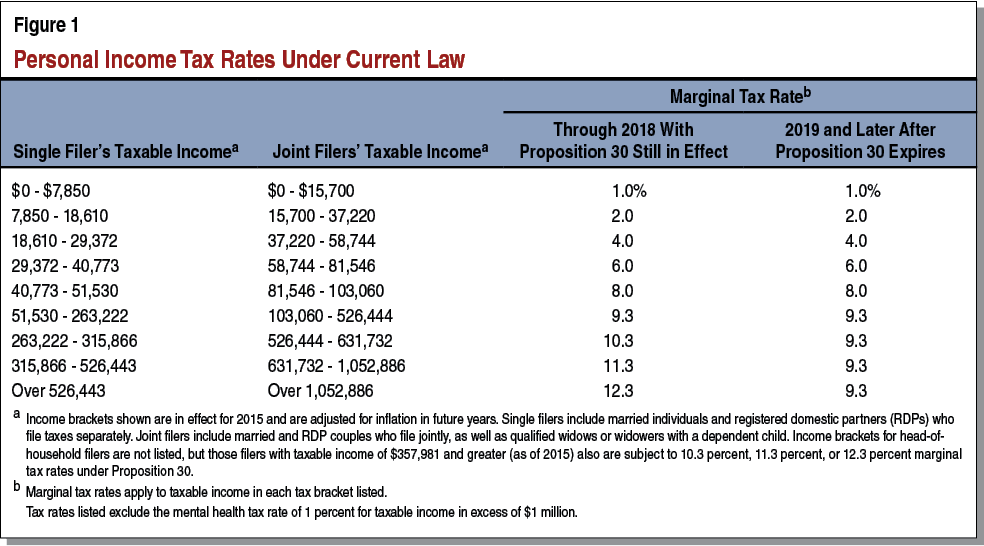

Personal Income Taxes And Funding For Education And Health Programs Amendment No 1 Ballot

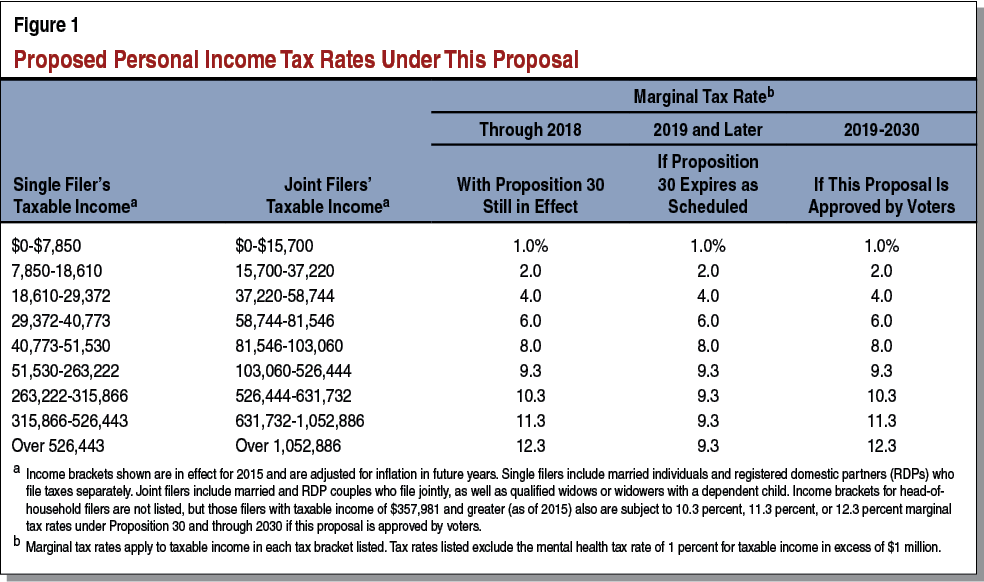

Temporary Extension Of Proposition 30 Income Tax Increases Amendment No 1 Ballot

Hiltzik Why Elon Musk S Taxes Are Important Los Angeles Times

Bob Brinker Fan Club Blog California Income Tax Rates

The Average Effective Tax Rate And How To Lower It Financial Samurai